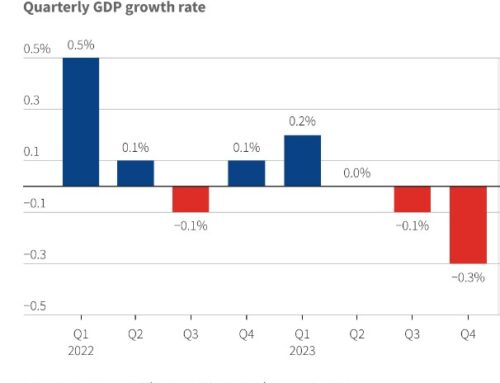

Higher than expected economic growth (6.5% this year and 6% next), along with much lower unemployment than anticipated, means that the Office for Budget Responsibility's (OBR) Covid-19 related economic scarring assumptions have been revise downwards from 3% to 2% of GDP. If this proves to be the case, it’ll be the lowest level of scarring from any modern recession.

This forecast enabled the Chancellor to announce greater spending on public services, driving economic growth and transitioning to a net zero economy at the Autumn Budget and Spending Review than many had anticipated.

The levelling-up agenda was writ large throughout the Chancellor's announcements, with investment in projects outside of London and the South East being highlighted. Whilst the much-anticipated Levelling-up White Paper was not published alongside the Budget (it is expected by the end of the year, although some rumours suggest even later), over 100 local projects to be funded via the Levelling Up Fund and the Community Ownership Fund were announced. 14 of these projects are located in the South East, however, none are in Buckinghamshire.

Elsewhere, England's city regions (those with metro mayors) will receive £6.9bn to spend on train, tram, bus and cycle projects. Although it’s worth noting that only £1.5bn of this is additional funding, most has been announced previously. Disappointingly for Buckinghamshire, the Chancellor did not take the opportunity to commit to the Aylesbury spur of the East West Rail link, which would improve access to jobs for residents, and would likely stimulate local economic growth.

In terms of business support, one announcement that may be more beneficial to businesses in Buckinghamshire than in some other parts of the Country is the temporary 50% cut in business rates for retail and hospitality properties, as many properties on struggling high streets further north are exempt from these rates. More broadly, whilst many businesses have called for business rates to be scrapped entirely, the reforms announced (more frequent valuations, wider reliefs and improved green incentives) are expected to be welcomed.

Sectors singled out for increased investment include: aerospace, life sciences, off-shore wind, automotive (electric vehicles), space and film. Buckinghamshire has assets and capabilities in many of these sectors, however, most investment does appear to have been earmarked for locations outside of London and the South East. Sectors singled out for further Covid-19 recovery support include: hospitality and retail, aviation, film and TV, live events, culture and haulage.

In terms of R&D, government has pushed its spending target back from 2024-25 to 2026-27. However, an announcement welcomed by many is that R&D tax relief will now include cloud computing and data spending.

Total spending on skills is set to increase over the parliament by 26% in real terms. With areas of investment including T-levels, Apprenticeships, college estate, Institutes of Technology and Skills Bootcamps (priorities set out in the Skills for Jobs White Paper released earlier in the year). In addition there was an announcement of funding to raise the numeracy skills of adults, through a new programme called Multiple. This will be delivered through the Shared Prosperity Fund.

For further details, the full Autumn Budget and Spending Review 2021 report is available here.